AUSTRALIAN property investors risk losing hundreds of millions of dollars after snapping up thousands of US housing bargains at forced-sale prices, experts have warned.Another article from The Age tells the story of the following couple:

Emboldened by the soaring local dollar, Australians invested about $600 million on US residential property last year, according to the Washington-based National Association of Realtors, as overseas buying of US housing doubled.

But consumer advocate Neil Jenman predicts that thousands of Australians will lose their money after unwittingly buying undesirable property.

''It's going to be a calamity, for sure and certain,'' he says.

CLEANERS Ana and Miguel Canepa never imagined when they fled to Australia as refugees they would one day be landlords of four rental homes. But the residents of St Albans in Melbourne's outer north west are living the Australian dream, having last week signed contracts to buy their latest investment property. And it only cost them $A44,117.

That is because the three-bedroom house is in the US city of Phoenix in Arizona.

The couple, originally from El Salvador, have never been to Phoenix. But they already own two other homes purchased there this year for $A41,000 and $A52,100, as well as a fourth rental asset in Melbourne.

Real estate specialist Kevin Walters, who arranged the Canepa's purchases, will next month lead a shopping tour for 10 Australians and a tax firm that advises self- managed superannuation holders. They will visit Phoenix and Las Vegas, the foreclosure capital of the US.

''You can buy a house in the US for the cost of a deposit here,'' he says. ''Clients can purchase property in just two days, it's that easy. The only exception is that we don't have a lender for them at the moment, so they buy in cash.'' Mr Thomas says he gets rental returns of 16 per cent on his US assets, compared to about 3 per cent for his Australian properties. ''It doesn't seem a risk at all to me,'' he says.

What could possibly go wrong?

The Age quotes a Byron-Bay based buyers agent called 888 US Real Estate, which according to its website charges a "committment fee" of $380 and then a commission of $3,420 for each property purchase it handles for the Aussie battlers trying to realise their dreams. But 888 US Real Estate is just one of a handful of organizations that are sprouting up like weeds to flog US property to unsuspecting Australian buyers. Here are just a few of the ridiculous sales pitches made on some of these websites.

- "It's no secret: USA property investment gives you a 10-20% net return... Even after your expenses are paid you will still make money with My USA Property"

- "Once American banks start lending again, the USA market will recover. So you’d be wise to invest in an undervalued market now since every Australian dollar buys more" (My USA Property)

- "When you say “Go!” you set the wheels in motion for an exhilarating ride as your property grows in value giving you the possibility to create enough cash to fund the rest of your life in a few short years. Call us now!" (888 USA Real Estate)

But for now, we should concede that some of the claims they make are accurate. It is indeed true that in many parts of the US today, you can buy a house for less than the price of a new car in Australia, or for less than the average deposit on a house in most Australian cities. Which raises another question. There are a lot of very smart American investors with a lot of money to burn. If properties in the US are such a bargain, why is it that many of these American investors still don't want to touch the property market with a ten foot pole?

Miami Vice

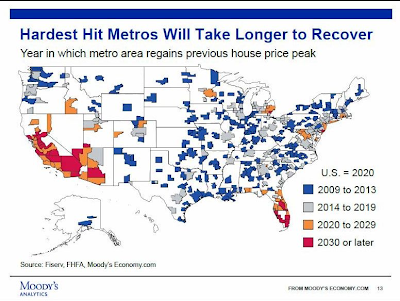

I'm not going to go into detail about what an absolute debacle the US property market is today, but let's just take a look at an interesting graphic in a recent report from the ratings agency Moodys. Moody's notes that there is still a massive surplus of housing inventory on the market, and that foreclosures and defaults are still skyrocketing in many parts of the country. You can see below that there are significant parts of California, Nevada, Arizona and Florida, where Moody's doesn't expect the housing market to fully recover until 2030. Yes, that's still two decades away.

And guess where the property spruikers are trying to talk Australians into buying investment properties? You're right. Places like California, Nevada, Arizona and Florida. Here's are a couple of listings in Florida from My USA Property:

Now, on the surface, property prices in Florida look like a real bargain, since they've already fallen around 45% in Miami and more than 40% in Tampa, as you can see below.

|

| Source: www.data360.org |

Unsuspecting Suckers

But there's no guarantee that prices are ever going to return to these peaks again, at least for a very long time in some of these areas. In fact, one recent study (which I might examine in more detail when I get the chance) argues that the housing bust may have created new types of "declining cities" across the USA -- certain cities which grew rapidly in the boom, attracting huge population inflows and investment -- but which are now facing the prospect of decades of stagnation thanks to a vicious circle of falling house prices, declining populations, rising vacancies, and increasing crime rates.

Some Australian investors are already finding this out the hard way. From the above story in The Age:

Sydney woman Kathy Graffiti bought three properties in upstate New York in 2005 and estimates she has lost between $300,000 and $400,000 on her investment. She bought two properties in Rochester and one in Buffalo for a total of $250,000, expecting rental yields of between 22-23 per cent.According to Neil Jenman, the consumer advocate quoted in The Age above, Buffalo, NY is one of the many areas where American "flippers" are buying up properties at fire-sale prices and then selling them on to "unsuspecting Australian suckers" at much higher prices.

The rental income stopped in 2007 and Ms Graffiti was forced to sell two of the properties at a significant loss. She has been offered $10,000 for the third property.

Typically, the American promoters work in tandem with Australian property spruikers who Jenman says are the "same rogues" who used highly questionable tactics when selling residential property on the Gold Coast and in the outer Melbourne suburbs.

Jenman says some Australians paid $50,000 for US houses with expectations of extraordinary rental yields and now can't sell the properties for $25,000. And he knows of an Australian who paid $80,000 for a house and now is unable to sell it for $40,000 – the best offer has been $10,000.

Dumb Things

Without a doubt, there are going to be some good investment opportunities in some parts of the US. But how the hell are you going to identify them from Australia, and can you really trust the clowns at places like 888 US Real Estate to pick the winners for you?

And that's not to mention the myriad of other problems involved with buying property in the US, which the property spruikers gloss over, but include:

- Significant foreign exchange risk

- Major tax complications including the necessity to pay income tax in the US on any rental income

- Stronger legal protections for tenants in the USA and a greater likelihood of lawsuits which can significantly raise costs for landlords compared to in Australia (see here for example)

It's time to wrap this up. Let's end with an appropriate Aussie classic from Paul Kelly.

Anon, was ripped off by unscrupulous ‘Property Investment Companies’ on his first two US property investments.

ReplyDeleteAnon decided to travel to the US, set up a US company, hire a US Attorney, hire a US accountant and build local real estate contacts, 19 properties later all equity purchases through Anon's US company,

Anon is keeping all the money he makes in the US in USD.

Anon is planning on moving and retiring to the US. ~10 yrs.

Anon is going to continue purchasing US properties.

Anon believes the "System" in the US is geared more towards the "Owner" than what Anon has experienced in OZ.

Hi Anon, would you mind if I contacted you?

Delete$$$ GENUINE LOAN WITH 3% INTEREST RATE APPLY NOW $$$.

DeleteAre you in need of a Loan to pay off your debt and start a new life? You have come to the right place were you can get your loan at a very low interest rate. Interested people/company should please contact us via email for more details.

E-mail: shadiraaliuloancompany1@gmail.com

Aussies planning to be millionaires by buying anything in California should think about this. There are literally hundreds of thousands of knowledgeable CASH buyers who are NOT buying. What do we know, that Aussies don't know? First if ANY house is going to be sold, at least 5-6 insiders will get a first shot at the deal..and they will buy in hours. Any property that you see on a list...is OLD, and probably a bad deal. I am a renter and have cash for several houses. 1/3 of the houses on my street are in some stage of sales, foreclosure or lien. There are offers on a GOOD and properly priced house before the ink is dry on the listing contract. HOW? INSIDERS! Realtors! One in 25 Californians is a REALTOR! You can get a license in a week of night online study. The exams are purposefully easy and require no formal education. All of these part time Realtors or family members who know someone want to be rich too. Many fail and end up broke or homeless.

ReplyDeleteThere is a small house across the street from me. In 2005 it cost USD $380,000...today it is for sale for $120,000. They have an auction every day. NO BUYERS! But that must sell the house...it has been over 3 months already. Why aren't people buying? The prices are TOO high! If you buy and rent out...what is to stop your tenant from giving notice and moving next door to the next empty house for rent at LOWER rent? Nothing! So how many months can you handle no tenants---no rent money? Tenants are not stupid...and many have money. We are tenants by choice. With cash I can buy and close in three days! That gives me power in the market. I tell you what.. I will be offering CASH 46k for that same house tomorrow - Under one name. I will know within 24 hrs if they reject my offer...and they will. But I do not care...I have another lower offer going in on the same house the next day and the next day each under a different name. It costs me NOTHING but a few emails. The bank is really dying...they will some day let the house go at a low price. If they don't - so what? No money lost. If they do---I will buy it---and sell it to you for 10k more- CASH only. I make a quick $10,000...and now its your turn to get rid of the house. I look outside my window and see five For Sale signs ---all "good deals", but why haven't they sold? They were from $750-899,000 only 4 years ago. One of them wants $450k....and has been for sale for 2 years. The asking price drops every month. Why buy TODAY...when the house will be cheaper next week? I have see some house go through 4 buyers sellers in 5 years. All the buyers thought they would be rich. Now you tell me why they sold? Rents are dropping every month...and my county has 22% unemployment. More than one in five adults has NO JOB! I saw a NEW house never sold...waiting for a buyer...the price is now lower than the cost to build. In my area its $43/sq ft to build new, but asking prices on some houses are still as high as $350 sq ft. ITS CRAZY! Two blocks from me they are BUILDING three NEW houses...These are 3,200 sq ft houses--the house not the lot. AND THEY WILL BE EMPTY. WHY? Crazy Americans and banker kick backs or politician kick backs...both illegal, but so is paying off a building inspector to look the other way. The city building inspector might get laid off tomorrow so they take the bribes. You want to be rich? DO YOUR HOMEWORK. NO ONE wants to live near gangs. Gangs are attracted to low rents and vacant houses to squat in. Gangs move in and All house prices drop in the area. I saw an ad for the 888 company showing a newer house near Atlanta Georgia to sell to Aussies. I called a friend who lived nearby the house. There was a gang murder two people shot one block from the house. Police have no suspects. People in gang areas will not talk...or they will be killed next. You can see the listing on the 888 website. Its on a corner lot, in suburb of Atlanta Georgia....waiting for a sucker in OZ land.

Hi, I've just visited 2 cities - Phoenix and Memphis - where I was shown several $50-60k detached homes with tenants already in place paying high rents - as long as they stay, a 50% loan can be paid off in 5 years etc - at some point you have to decide whether any realtors in the US can be trusted - the streets looked good enough and no apparent evidence of other homes they could switch to for lower rents - I'm now writing a book on buying in the U.S. - anyone with any comments or tales of woe, please let me know at USproperty@email.com - thanks, Alan Simon

ReplyDeleteYou wrote "You can see below that there are significant parts of California, Nevada, Arizona and Florida, where Moody's doesn't expect the housing market to fully recover until 2030. "

ReplyDeleteWhat crap. Moodys can never get anything right. The housing market will go through ups and downs before 2030. I cant believe you publish this S$%T.

LBS

LBS > Unfortunately you have completely missed the point. The point is not whether or not Moodys' view of the housing market is correct or not, it is whether or not the Australians buying these properties have a sufficient understanding of the risks involved. That's all.

ReplyDeleteFF,

ReplyDeleteI appreciate what you are saying but in a recent blog you write" Economists. What are they good for?" Then I read this and you talk about Moodys predicting this 2030. I just sounds like a contradiction. I am on your side about investing in the US as I from there. You have to be very careful. Especially if there are things from the past on the house. I will never forget the press in Australia wrote this glowing article a year ago about people buying houses in Detriot for 10k or something. I laughed my ass off. My very good friend moved up there from Nashville to invest in property. It was a nightmare and he moved back. Actually lost some money. Talke about the most corrupt part of the US. I couldnt believe what I was reading as Detriot is the worst place to invest in and everyone over in the US knows that. I am not against you and really like your blog just dont like reading something that is BS about prices wont rise until 2030 and its quoted from a resource(Moodys) that never gets anything right. Great blog really enjoyed your piece on Australia overdependence on China. Its going to come back and bite the country.

Cheers,

LBS

When they talk about markets recovering in 2030, don't they mean prices reaching their bubble levels again? (ie. if you bought at the top of the bubble, you will break even in 2030). In other words these markets could start to rise before then. I don't think people are buying expecting the bubble to suddenly reinflate itself...

ReplyDeletePF

PF,

ReplyDeleteYou're right -- Moodys is talking about the time taken to return to peak levels. Keep in mind that this is in nominal terms, before taking inflation into account. If you bought at the peak and prices returned to that level nominally by 2030, you'd have made a significant loss in real terms.

Cheers,

FF

Got to love journalist who don’t research the facts before writing articles or just make things up to fluff an article. ie The Age. Mrs Graffiti (Got to love the name, how about Mrs Smith) buys 3 properties in 2005 for $250k. OK, she's has them rented for 2 years. Forced to sell them and loses $300k-$400k. Ha. How does that work? (If sold in 2007, that’s the height of the boom) AUD/USD was pretty much the same, so no currency loss. So one day she has 3 properties, the next she's lost $300-$400k, (Big difference there) then why would you have sold them? The Age story doesn’t make sense. If you buy anything , anywhere you need to do you due diligence. Its a bit like buying a $5M property in Blacktown, And complaining when comes to sell, is only worth $300k. You would think if you’re going to spend $250k, you might spend $2k on a plane ticket and going to see what you’re actually buying.

ReplyDeleteThe article should have been a warning on Stupid People live amount us, rather than a warning on US property.

American parents are advising their kids to stay out of the real estate market for next 10-20 yrs due to demographic distortions, the volume of financial jackals, and big questions regarding peak oil adaptations. There is not a location within the US which has escaped - even areas which never participated in "the boom".

ReplyDeleteBut Aussies smoking that same "debt crack" which did *us* in clamor to join the party?

Thanks for the update. I really appreciate the efforts you have made for this post. Online sports tickets are really becoming very popular these days.

ReplyDeletehere i want to ask you sir that who much property a person in California, Nevada, Arizona and Florida?because some of countries people can have limited property on their name?

ReplyDeleteGreat and very useful post!

ReplyDeleteBy

Cutca.com

I truly like to reading your post. Thank you so much for taking the time to share such a nice information. I'll definitely add this great post in my article section.

ReplyDeletehonolulu commercial real estate

Even Chinese people are up to investing and buying US properties too. They may have been seeing a low home value that could get high in the future and so they are getting the chance to own and buy a property to invest in for the future when the housing market gets stable and recover.

ReplyDeleteflorida real estate license

This post was simply amazing. I had a great time reading it and I find it impressive as well.

ReplyDeleteCharles A

This blog is in desperate need of perspective. All investment vehicles are inherently risky. Property investments of any time included. The risk is exacerbated exponentially when human beings fail to exercise prudence! Insufficient due diligence is the single biggest risk factor of any investment. All the above examples of failed investments reek of incompetence. It would truly be sad except that due diligence is hardly an art, in fact it's relatively simple. I'll accept it takes a certain capacity to think, be creative, patient, thorough and diligent, but isn't your hard earned money worth it? Instead people want unrealistic gains, they want it right now and they don't want to work hard for it. This bloggers time would have been better allocated in presenting an unbiased view of the process needed to competently work through, fully understand and navigate such an investment. However I fully understand it take less of an intellect to simply "have a bitch"

ReplyDeleteMy short term strategy is to steer clear of any investments involving US dollar-denominated assets even though I believe that there is a return to be had for the prudent investor, investing "long term" in the US property market.

All the best in wealth

student accommodation in Leeds

ReplyDeleteEven The china are up to committing and purchasing US qualities too. They may have been seeing a low home value that could get high later on and so they are getting the opportunity to own and buy a property or home to get for the long run when the real estate industry gets constant and restore.

There are a lot of very smart American investors with a lot of money to burn.As a small business consultants melbourne I appreciate your post...!!! Thanks

ReplyDeleteI will not buy in Australia as prices are way too high. The house price to income ratio here in Australia is out of control and unsustainable.

ReplyDeleteI am looking at buying in the USA but first I need to do thorough research on how I can buy property in the US as a non US resident and how tax works plus other costs associated with property. My aim is to buy in New York City. I will not rush into this as I am wary that third parties can rip you off so it is extremely important for me to do my own research and buy directly avoiding the middleman in the process.

One of the most common ways of purchasing a below market value home is through a favourable sale. With a favourable sale, a parent will sell a home to their child for less than the market value. This is ideal for younger people that do not have the necessary funds available to make the deposit for a home of that price. It could drastically improve their chances of being approved for a mortgage.

ReplyDeleteThanks for the post, great tips and information which is useful for all. Keep posting...

ReplyDeleteAllied Investment Corporation

we are the dealers in the market, and dealing in REO properties for sale we have many places we are selling on cheap rates.

ReplyDeleteHi,just wondering if anyone could give me the answers to the following questions regarding Tax and capital gains.

ReplyDelete1:Do I have to pay tax or declare income to the Australian Tax Dept from Income from a positve geared propety in the USA.

2: Would I have to pay tax on income to the USA govt?

3: Is there a tax free threshhold like in Australia?

4: If I sold the property is there capital gains tax payable in the USA?

5: Would I aslso have to pay capital gains tax on the profit in Australia?

Do your homework and look on the ATO website.

DeleteThis is just a bit if the info I found:

Receiving rent

Remember:

■ You must include the total rental income from your overseas real estate on your Australian tax return – even if it has been, or will be, taxed outside Australia.

■ Rent from overseas real estate is included at the ‘Foreign source income and foreign assets or property’ item on your tax return.

■ If you have paid foreign tax on income you received from overseas real estate, you may be entitled to a foreign income tax offset (formerly known as a foreign tax credit).

■ You are only entitled to a foreign income tax offset for tax you have actually paid.

■ Your foreign income tax offset is also included at the ‘Foreign source income and foreign assets or property’ item on your tax return.

To work out if you are entitled to a foreign income tax offset, you can visit our website at www.ato.gov.au and search for Guide to foreign income tax offset rules.

Claiming rental deductions

Remember:

■ Tax deductions on your rental property can include – rates – interest – insurance – real estate agent fees – depreciation – deductions for capital works.

■ If your overseas property tax deductions are greater than your overseas rental income, you will have a foreign income loss.

■ You can use your foreign income loss to reduce your Australian income.

Paying capital gains tax

Remember:

■ Australia applies a tax to any profit you make when you sell (or otherwise dispose of) real estate both in Australia and overseas. This is called‘capital gains tax’.

■ You must include any capital gain or capital loss you have made from your overseas real estate on your Australian tax return – even if it has been or will be taxed outside Australia.

■ You can use your capital losses to offset the capital gains you make on other assets.

■ You need to include your capital gains and capital losses at the ‘Capital gains’ item on your tax return.

■ If you have owned your property for more than 12 months, you may be able to reduce the amount you include on your tax return by 50%.

■ If you have paid foreign tax on your capital gain, you may be entitled to a foreign income tax offset (formerly known as a foreign tax credit).

I heard that Australian house prices are likely to tumble in the next two years..your views on this on..??

ReplyDeleteand on the other hand The Australian commercial real estate market continues to be fairly balanced as compare to residential..

Land for sale Central Coast

There are both advantages and disadvantages to doing business in the US. It is important to understand what you or your company is getting in to before committing. The American Chamber of Commerce runs an educational tutorial featuring five independent experts that will teach you the rules to importing, exporting and investing in the US.

ReplyDeleteSee: http://www.amcham.com.au/vpLink.aspx?ID=4200&EVENT=2232&STATE=NSW

Sounds great! Nice to know about that.Many people will remind regarding on the concept of your page.Thanks for publishing this.

ReplyDeleteYou can write and read reviews about cities, insurance companies, antivirus, smartphones, operating systems and tablets. You can also post jobs, sell items, post rent and find investment. Try it www.planetadvert.com

ReplyDeleteAs I gather my information about Real Estate Investment in Australia. I find it enjoyable to stay in a place there. A bit of different cultures that attracts tourist is why I like there. I think I would also consider Australia as one of the place that I can stay for good.

ReplyDeletehttp://www.realestateinvestment-australia.com.au/

We should be focused in any decision we make. Make sure that we have the right decision to ensure the safety of our business. Property investment is a business we should be focused from time to time. Making sure that we don't give chances on being a failure.

ReplyDeleteReal Estate Investments

manaslu trekking,offering magnificent views of the mount, Manaslu, hinchuli, ganesh himal and exotic Tibetan Nepalese culture.

ReplyDeleteWhich is why I have been urging my private clients to build a portfolio of investment properties. investment property and smsf

ReplyDeleteWe must be aware of the things that we might do that will result to negative things. Avoiding things like that to happen will be more appropriate. We should do what is right for the business. Make sure that we are able to control things for the betterment of the business.

ReplyDeleteReal Estate Investment

Buying houses is nowadays is very easy...as it require proper direction to get right path of investment through many service provider.One of the service provider is Burnaby Property Agent.

ReplyDeletethnks....for the post

DeleteThanks for sharing this superb information with us. phoenix property management

ReplyDeleteI think the truth is somewhere between the overblown rhetoric of sellers like 888 and the overly negative view set out in this post. Yes, there are great returns to be had in US property. And, yes, there are significant risks, although these apply to greater and lesser extents to all investments, including Australian property. The key to maximise returns and minimise risk is to do your research. Interested parties might like to check out our book Buying Property in the USA: A Foreign Investor's Guide (www.buyingpropertyintheusa.com). As far as we are aware, it's the only such title geared to overseas buyers.

ReplyDeleteHi

ReplyDeleteI am currently an Aussie in St Louis buying and renovating houses for rentals and to sell when the make picks up. I bought my first house online paying inspectors and realtors who said it was a good property. It was not exactly the truth as this house needed more repairs and was not in the best street. I have rented that house out for US700 per month on a USD35000 all up purchase. It is valued at USD50000 and insured for replacement value of USD130000. I have bought great deals in good areas and the secret is ....you have to be there and do most things yourself. I have a good realtor who knows how to close the deals and ensure titles are cleared correctly. I know have good contractors who can do the work ...beware as I found most american contractors full of BS and will charge you aussie rates. For example I was given 2 estimates for plumbing a 4 family building (that is 4 one bedroom apartments in a good area that we purchased for USD52000 - try buying this in Sydney lol), the first two bids were USD30k each...I got a plumber who did a great job for 10k. I do believe the market is picking up here...more US investors are buying in. Houses prices in the areas I have bought have risen 5% over the past year and St Louis is a relatively stable city which is not bankrupt like other cities in the USA. So yes you can make money here if you do the hard work yourself and not rely to real estate agents and the other sharks in the pool. BTW I sold all my houses back home by myself at prices above what I was quoted by agents...So real estate is not hard if you understand how it works and do the hard work in buying the best property at the right time.

Its really very good and important blog.I found many information at this time.Its very help full information for me and I would like to sharing this information others.Thanks for sharing this information

ReplyDeleteits great news for buying Australians buying US property...

ReplyDeleteProperty in Bangalore | Property in chennai

I find this post very interesting. I have also heard about Australians buying US properties. And there are Americans who want to buy property Australia.

ReplyDeleteBuying houses is nowadays is very easy...as it require proper direction to get right path of investment through many service provider.One of the service provider is Property Buyers.

ReplyDeletenice blog with some nice pics thanks for thisphoenix property management

ReplyDeleteAn impressive post, I just gave this to a colleague who is doing a little analysis On Phoenix Property Management on this topic. And he is very happy and thanking me for finding it. But all thanks to you for writing in such simple words. Big thumb up for this blog post!

ReplyDeleteAs we all know, we need to have a good income for our family. Income that will allow us to support their needs. That is why I think that Property Investment is the best business to invest because many people that I know who invested are now a successful businessman.

ReplyDeletehttp://investmentinreal-estate.blogspot.com/2013/04/retirement-property-investment.html

Australians wants a better life than others that is why they walk behind the priorities.

ReplyDeleteImoveis Em Miami | Miami Beach Condos

This is a wonderful post! Thanks for sharing your knowledge with us! I hope to read more of your post which is very informative and useful to all the readers. I salute writers like you for doing a great job!

ReplyDeletephoenix property management

Thank you for sharing valuable information. Nice post. I enjoyed reading this post. The whole blog is very nice found some good stuff and good information here Thanks..Also visit my page

ReplyDeleteProperty consultant Sydney

Awesome blog over here! Thanks for sharing this very useful information. I will visit your blog again in a couple of days to check if you have some new articles

ReplyDeletePhoenix Property Management

I wish that I had found you sooner! The very popular realtor who had my

ReplyDeletelisting before you, listed it way too high and the property was a horrible

mess. Since I now live in Oregon, I was unaware of the condition of the home

and the way it was being ignored. A very short time after you took over the

listing and helped direct our cleanup efforts, it was sold for a reasonable price.

Mortgage After Foreclosure

Mortgage After Short Sale

Home Loan After Foreclosure

Home Loan After Short Sale

Financing After Short Sale

I loved reading this piece! Well written! :)

ReplyDeletejason

investment properties

The content was really very interesting. I am really thankful to you for providing this unique information. Please keep sharing more and more information......phoenix property management

ReplyDeletei have seen your website,

ReplyDeletepretty well and i have stumbled

thanks.

South beach condos | Aventure condos

When you're getting ready to sell your home, it's easy to get carried away in the excitement of trying to get it in its best condition before it hits the market. homes for sale mn is hassle free way to search the MLS online MN. Through broker reciprocity buyers can view all Northstar MLS online MN listings! No sign up necessary!

ReplyDeletelast week i went to australia and in a city i joined a event where most of condos builders were introducing their services.

ReplyDeletei was very exited to see that they also have good ability of work.

Miami Houses | Aventura Condos

This information in this blog is really a appreciable. I would really like to say that the knowledge you have about this is quit impressing. But the main thing here is the way to present the information, and you have done it very nicely. Great work and love to visit on your blog again and again. Keep posting nice information.

ReplyDelete------------------------------------------------------

2bhk flat in gurgaon | residential house in gurgaon

Hi, just a moment back I was searching for the information on the same topic and now I am here. So much information, really well executed blog. This is really informative and I will for sure refer my friends the same. ThanksPheonix property management

ReplyDeleteWe must know as an individual to know how to handle situations clearly regarding Property Investment. Rightful thing to do is to be get more knowledge about the business. Make sure that you are stable in putting up the right thing at the same time.

ReplyDeletehttp://real-estate-investments101.blogspot.com/2013/05/real-estate-investments.html

Home construction is also in demand, especially around the major cities. Purchasing a land or house is good investment. Berstan Homes Pvt Ltd. gives you a good opportunity to buying a home with the best price at the good location.For more info visit on: http://www.berstanhomes.com.au

ReplyDeleteVery right article about the investment property in Real Estate.

ReplyDeleteSell your house for cash in New York

With the Case Shiller Home price index rising to its highest level in 5 years in May 2013, all doubts about the capital growth momentum and home price recovery are moot points now. At 888 US Real Estate we target the Atlanta market now which showed a 20.1% increase in median price in the last 12 months. With the Australian dollar falling it is a good time to own cash producing US assets.

ReplyDeleteAnyone who doubts the extent of the home price recovery should google "Blackstone" to see how huge US hedge funds are buying billions of dollars worth of single family homes in the USA. In regard to the spook appeal of the head article, it is easy to bag things you have not done or do not have direct knowledge about. Having steered Australian investors into 580 US property transactions since 2009 I can attest that it is doable, extremely profitable and very exciting given the currency and growth momentum available now. If you want the research in a condensed form look for my youtube videos and downloadable reports at the USRE888 channel.

Vincent Selleck

888 US Real Estate

I really like this blog.I really love to share this blog with all my friends. You are really sharing us good knowledge about this.

ReplyDeleteProperty for Sale in Bhiwadi

The housing crisis has left the United States property market in turmoil with cheap costs on foreclosed homes everywhere the country, gap the door to foreign investors. Aussies, WHO area unit wont to one amongst the foremost pricy land markets within the world, area unit flocking to the United States market at record numbers. the foremost common strategy for Australian investors is getting distressed properties through some quite trading deal from the bank.

ReplyDeleteBuy Bulgarian Properties online

in any city every one want to purchase his own home but if your are from australia and your are looking for a good house than please contact buying a house toowoomba

ReplyDeleteThank you for your article, I have been looking for this for a long time

ReplyDeleteWe need to take our time and effort that we use for our Real Estate Investments Australia and make sure that all things that we do is for the benefit of our business. Other than anything else, we must first do the learning phase of our business. Make use of the time that we have to learn and also find the answers for our business to be successful.

ReplyDeletehttp://property-investment-portfolio.blogspot.com/2013/06/property-investment-points-to-consider.html

Buying house is a great deal. I have got some tips from a Sell my house fast for cash company. They are really doing awesome around. For buying or selling house people depend on them a lot.

ReplyDeleteNice information! Thanks for sharing this type of information...

ReplyDeleteFinance and Leasing Specialists in Australia

Great blog. Your blog is interesting and so informative. Wait for your next blog post. Thanks for sharing with us. Property Investment Australia

ReplyDeleteSo what is the problem with Australian people buying US properties? If they have the money why not? Real estate professionals are not really concerned about who's going to buy. If they wanted a Dallas commercial real estate, then they can have it.

ReplyDeleteThat's ideas but give me some other advice for properties investment in Australia .Real Estate Investing is so good.

ReplyDeleteAs the tower (Platinum) rises above this podium it breaks the sky with a crown form that is carefully articulated so as to make a positive contribution to a dynamic skyline. Read more about the Platinum project of the Salvo Property Group here: Real Estate.

ReplyDelete$$$ GENUINE LOAN WITH 3% INTEREST RATE APPLY NOW $$$.

DeleteAre you in need of a Loan to pay off your debt and start a new life? You have come to the right place were you can get your loan at a very low interest rate. Interested people/company should please contact us via email for more details.

E-mail: shadiraaliuloancompany1@gmail.com

Supertech Micasa Bangalore will be situated at one of the best but unexploited area of Bangalore, the Thanisandra Road

ReplyDeleteHi all.

ReplyDeleteI purchased a property in Atlanta through 888 Real Estate 6 months ago with the promise of a 'Fully renovated' condo which will rent at $850.00/month. In fact the property needs several thousand dollars with of repairs to get it to a stage where it (might) rent for $750.00/month. The seller at 888, or buyers agent as he prefers to be known assumes no responsibility even though his promises were all stated in his selling pitch. I'm now preparing a legal challenge as well as a follow up with the office of Fair trade etc and I will do everything in my power - ongoing - to let as many people know as possible that this guy is as crooked as they come and V.S. will do whatever it takes to make a sale and you will be left high and dry as soon as your chq is cashed.

DO NOT DO BUSINESS WITH 888 REAL ESTATE IN BYRON BAY.

Does anyone know where else I can post this information to inform an unsuspecting public of the perils of dealing with this crooked creep?

Thank you.

Hi Anon, would it be OK if I contacted you regarding some questions I have

DeleteSupertech Ltd has come up with another of structural wonderful things and has known as it Supertech Oxford Square.

ReplyDeleteHi excellent blog post. I really appreciates with your article. thanks for sharing great stuff for real estate. Property Investment Professionals Australia

ReplyDeleteI appriciate exactly what you've supplied to those people wish to learn as often about real estate investing . Your site is obviously one of several better ones out there.

ReplyDeleteUS Property investment

Finally but not at the record, you have to more genuine in your desire when you are in near situation in plenty of duration of purchasing Detroit qualities.

ReplyDeleteGreat article...really useful for those who want to start investing in real-estate..very helpful! thanks..keep posting.. Property Investment Services .

ReplyDeleteOur hard work will show how our investment can become. We have to ensure the success of our business by doing everything and finding ways as well. The future of our Real Estate Investments is from what we have achieve to ensure our business stability.

ReplyDeletehttp://www.realestateinvestment-australia.com.au/

We are a Real Estate Investment group We buy, sell and whoelsale homes, multi unit and commercial properties. For more information please visit this site: at

ReplyDeleteStarlite and starlitepi@aol.com and fill out the form on the site

Thanks for the wonderful article. But I would just like to take your opinion about buying a house for living and not renting. Do you think buying a house is a good idea or investment.

ReplyDeleteProperty Investment Coaching

Good article to read.

ReplyDeleteInvesting in real estate for different purposes will result to different outcome but good thing is that there is the return of investment.

http://realestateinvestment-australia.com.au/

good site thanks for sharing

ReplyDeleteProperties for sale in Houston

good article to share with.

ReplyDeletereal estate is a great investment to go into because of the great return and value of money increases.

#australia real estate

http://realestateinvestment-australia.com.au/

Real Estate Investments is a great source of revenue. Since the value of a property increases in a yearly basis. Investing in the right place you can earn a huge profit through this business.

ReplyDeletehttp://wallarooshores.com.au/

This is a very interesting article.

ReplyDeleteIf I can be able to pay for the monthly amortisation of a property I'd rather go investing than go into renting. Renting is for those who can not pay the monthly amortisation. It is better because we can have the property after couple of years of paying compared in renting.

If you've decided in investing in real estate I would suggest to visit the site below. This will help in quick and easy investment.

real estate investment

This is really a great article.

ReplyDeleteReal estate investment is indeed a long term and sustainable income. There are various reason why people invest in real estate. 5-15 % of your investment in 20 years will at least double the investment capital or quadruple the result.

This is why investing in real estate is really a great investment to start with.

You just have to be ready with the capital and some information that Positive Property Investments can provide you or assist you with aside from the property that you are looking for.

real estate investments

I've heard from one businessman that you need to invest 20% of your income to be rich.

ReplyDeleteStart doing the investment now and real estate is one of the good investment. Do you know how to much return of investment have you acquired in the past years of investing in real estate?

There are some things that we should understand to appreciate the real estate investment business.

Starting it would be difficult if you do it on your own. Try visiting site below to have a better understanding on the real estate business.

real estate investments

Really nice information. continue to share the information

ReplyDeleteWeb Design Company Bangalore

Web Designing Bangalore

Web Designer Bangalore

Dear Sir/ Madam

ReplyDeleteAre you interested in obtaining a loan at an interest rate of 3%, you

need a loan for a business transaction, buying a car, house

purchase bad credit card and other E.T.C we give out long terms loan

for five to fifty years maximum with 3% interest in

Maybe you like it

well tell us the amount you need so that we will send to you the terms and

provided that, if you're really interested in getting

loan from us,

Loans issued in Great British Pounds and U.S. dollar.

We can give you the best satisfaction in getting a loan from us. as

given guarantees and insurance that you will get your loan amount in your

Personal bank account in your country. What takes only 48 hours

Banking process. We also provide software and

unsecured loans for

Running your business. you can kindling reach us via < ponyeefastloan.ch@cash4u.com << <<< ponyeecashloan@gmail.com >

This is really very good topics. I have earned $ 1500 today from this site and I have earned over 20000 USD in this month by using this site. This is great and important elements in the modern world that mean (click here - how to make money.) I have always wanted to know how to make money easily from home without so much investment. I have got it and doing my dream. You are most welcome in this site! Thanks so much!

ReplyDeleteThis is really very good topics. I have earned $ 1500 today from this site and I have earned over 20000 USD in this month by using this site. This is great and important elements in the modern world that mean (click here - how to make money.) I have always wanted to know how to make money easily from home without so much investment. I have got it and doing my dream. You are most welcome in this site! Thanks so much!

ReplyDeleteBali is a Countryside nature-friendly and cultural retreat, Known for its scenic beauty, liberation, awakening perfection and contentment. Land in Hyderabad Bali spread Across 240 acres, comprising of 'Bali Village' (Plots & Villas) and 'Bali Bamboo Farms',

ReplyDeletehttp://www.incrediblelands.com/bali-farms.html

Good work…I appciate you to give such a nice information on Realestate… keep it up…looking forward for more updates.

ReplyDeleteLow commission property sales

This comment has been removed by the author.

ReplyDeleteBishops Gate Homes for Sale We specialize in helping people buy and sell real estate in Raleigh, Cary, Durham, Chapel Hill, Morrisville, Holly Springs, and Fuquay Varina. Put my real estate experience to work for you, making your next home sale/purchase a pleasurable one. Our Triangle Realty Aconites office is located in Cary and we serve the greater triangle region (wake, durham, orange, and chatham counties).

ReplyDeleteThis information in this blog is really a appreciable. I would really like to say that the knowledge you have about this is quit impressing. But the main thing here is the way to present the information, and you have done it very nicely. Great work and love to visit on your blog again and again. Keep posting nice information...........

ReplyDeleteBest student accommodation in Huddersfield | Where can I live close to Huddersfield University

i am Lee Shen by name, the C E O, of Lee Shen loan firm, i give loans to reliable individuals and company at 2%interest rate,are you in dept or do you have bad credit, do you need a business loans, car loans,home improvement, international loans and more.come your problem will be solve.we do not stress our customer contact us now by mail [**leeshenloanfirm@consultant.com** or ***shen52372@gmail.com***] yours faithful Lee Shen.

ReplyDeleteGreat blog This is a very interesting article.If I can be able to pay for the monthly amortisation of a property I'd rather go investing than go into renting. Renting is for those who can not pay the monthly amortisation. It is better because we can have the property after couple of years of paying compared in renting.Thanks for sharing........

ReplyDeleteKingsmill Studios | Closest student accommodation to Huddersfield University

develop your real estate buisness with proper tricks please follow us on :- There are huge amount homes for sale in larchmont ny related ordering the work by the place of the main consideration as soon by means the reality when all gets home building plan finalized they can homes for sale in mamaroneck ny

ReplyDeleteIt gives necessary and appropriate information about property and real estate management market. Good article at all. I give it full marks. This site is getting better with time.

ReplyDeleteThe best Real estate agent in Spain at our immoabroad site in Spain. Find and contact the most renowned agent in Spain and the best professionals agent.

ReplyDelete$$$ Loan apply now with 3% interest rate for more details $$$

ReplyDeleteAre you looking for a Loan to enlarge your business? Do you need loan to pay off your debt and start a new life? You have come to the right place were we offer Loans at a very low interest rate of 3%. Interested people/company should please contact us via email for more details and get funded.

Email: shadiraaliuloancompany1@gmail.com

Application For loan.

First Name:

Last Name:

Date Of Birth:

Address:

Sex:

Phone No:

City:

Zip Code:

State:

Country:

Nationality:

Occupation:

Monthly Income:

Amount Needed:

Duration:

Purpose of the loan:

E-mail address:

Email: shadiraaliuloancompany1@gmail.com

Why wasting your precious time online looking for a loan? When there is an opportunity for you to invest with $200 and get a returns of $2,000 within seven business working days. Contact us now for more information if interested on how you can earn big with just little amount. This is all about investing into Crude Oil and Gas Business. Email:investmoneyoilgas@gmail.com

ReplyDeleteEmail Us:(investmoneyoilgas@gmail.com)

Regard

DR JAMES ERIC

$$$ URGENT LOAN OFFER WITH LOW INTEREST RATE APPLY NOW $$$

ReplyDeleteDo you need Loan to pay off your debt and start a new life? You have come to the right place were you can get FUNDED at a very low interest rate. Interested people/company should please contact us via email for more details.

Full name:

Date of birth (yyyy-mm-dd):

Gender:

Marital status:

Amount Needed:

Duration:

Address:

City:

State/province:

Zip/postal code:

Country:

Phone number:

Monthly Income:

Occupation:

E-mail: shadiraaliuloancompany1@gmail.com

A very good and informative article indeed. It helps me a lot to enhance my knowledge, I really like the way the writer presented his views. Property Investment Company

ReplyDeletewhats literally the most fastest way to make money?

ReplyDeletewholesale houses for sale houston

Hello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of S$250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of S$250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.

BORROWERS APPLICATION DETAILS

1. Name Of Applicant in Full:……..

2. Telephone Numbers:……….

3. Address and Location:…….

4. Amount in request………..

5. Repayment Period:………..

6. Purpose Of Loan………….

7. country…………………

8. phone…………………..

9. occupation………………

10.age/sex…………………

11.Monthly Income…………..

12.Email……………..

Regards.

Managements

Email Kindly Contact: urgentloan22@gmail.com

Do you have bad credit or in need of urgent loan to solve a pressing need? We lend secured and unsecured loans to honest and reliable individuals and companies globally at 3% interest rate. Here is the solution to your financial problem, do you also need money for your, project, business, taxes, bills, and many others reason, contact us today for that loan you desire, we can arrange any loan to suit your budget at low interest rate.Contact us (mrhamdnloanoffer@gmail.com)

ReplyDeleteLOAN APPLICATION INFORMATION FORM

First name:

Middle name:

Date of birth (yyyy-mm-dd):

Gender:

Marital status:

Total Amount Needed:

Time Duration:

Address:

City:

State/province:

Zip/postal code:

Country:

Phone:

Mobile/cellular:

Monthly Income:

Occupation:

Which sites did you know about us.....

Contact Us At :mrhamdnloanoffer@gmail.com

Thank you for nice Article

ReplyDeleteif Looking for a Home loan brokers melbourne ? You have come to the right place

Get attractive rates on smart Loan Providers . Apply online now and get instant Approval. For more details, call us @ 1300-429-263

ReplyDeleteBlacktown Real Estate St Marys real estate, St Marys real estate agent and real estate blacktown at yourplace.harcourts.com.au. Learn more about our St Marys real estate agent, blacktown.

Thank you for bringing more information to this topic for me. I’m truly grateful and really impressed.

ReplyDeletereal estate agents Toowoomba

Hello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of S$250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of S$250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.

BORROWERS APPLICATION DETAILS

1. Name Of Applicant in Full:……..

2. Telephone Numbers:……….

3. Address and Location:…….

4. Amount in request………..

5. Repayment Period:………..

6. Purpose Of Loan………….

7. country…………………

8. phone…………………..

9. occupation………………

10.age/sex…………………

11.Monthly Income…………..

12.Email……………..

Regards.

Managements

Email Kindly Contact: urgentloan22@gmail.com

We have effectively broken the mould of the traditional accountant, and harnessed technology in order to deliver a broader range of advisory services. We are dealing in accountants gold coast, gold coast accountants, accountant gold coast, tax accountants gold coast, gold coast accountant, gold coast accounting, tax accountant gold coast, tax return gold coast or accounting firms gold coast, accounting gold coast, small business accountants gold coast and small business accountant gold coast.

ReplyDeleteI really appreciate your blog and this blog have very useful and interesting information about the wealth management and property.

ReplyDeletetax minimisation

Wonderful article, thanks for putting this together! This is obviously one great post. Thanks for the valuable information and insights you have so provided here.

ReplyDeletetoowoomba real estate agents

It is very good post about Australian property. I will appreciate your post as your discussed here.

ReplyDeletebest investment suburbs sydney

Beautiful and informative share.. I just shared this post with my friend who is going to settle down in Australia next week and she found this post helpful.

ReplyDeleteTo Whom it may concern!!!

ReplyDeleteAre you a businessman / woman? Are you in any financial mess or you need

funds to start your own business? or to pay off your bills or start a good

business? Contact us on davidmike756@gmail.com. You can also Text or Call

Our Head Office In United state of america on +19513561932.

required to fill the info :

Name—-

Amunt—-

Duration—-

Phone number—

Country—

Regards,

FROM: DAVID MIKE Loan Company

+19513561932.

davidmike756@gmail.com

Good article. I like the article and post. Thanks for sharing this post.

ReplyDeletetoowoomba real estate agents

The Building Inspection Gold Coast provides building inspection reports across Gold Coast and greater QLD.

ReplyDeleteThis is excellent article on Australians buying US properties but I have been looking for best properties in Dove mountain real estate as I heard they are providing beautiful homes. So I am planning to buy a property from them for investment purpose. Any suggestions?

ReplyDeleteDo you need any Financial help such as Loan?If yes email us at Brent.timmons@ymail.com for more details.

ReplyDeleteI can see that you are an expert at your field!;; I am launching a website soon, and your information will be very useful for me.. Thanks for all your help and wishing you all the success in your business.

ReplyDeletePalm Beach Investment Properties

ReplyDeleteIf you want take Loans

Reach with Us

Mortgage brokers Melbourne

Best Personal Loan Melbourne

Home Loan Brokers Melbourne

Commercial Property Loan

Home Loans Melbourne

Home Loan Interest Rates

Car Loans Melbourne

Home Loan Rates

ReplyDeleteIs it time to sell your california land? We make selling your land a quick and easy process, and it costs you nothing out of pocket. For more information then Visit: www.purelandbuyers.com

Sell land fast

i want to sell my land

Selling your land

To Whom it may concern!!!

ReplyDeleteAre you a businessman / woman? Are you in any financial mess or you need

funds to start your own business? or to pay off your bills or start a good

business? Contact us on davidmike756@gmail.com. You can also Text or Call

Our Head Office In United state of america on +19513561932.

required to fill the info :

Name—-

Amunt—-

Duration—-

Phone number—

Country—

Regards,

FROM: DAVID MIKE Loan Company

+19513561932.

davidmike756@gmail.com

Thank you for Wonderful article... If you are Looking for a Best Mortgage Broker Melbourne ? You have come to the right place

ReplyDeleteGet attractive rates on smart Loan Providers . Apply online now and get instant Approval.

Thank you for Wonderful article... If you are Looking for a Best Mortgage Broker Melbourne ? You have come to the right place

ReplyDeleteGet attractive rates on smart Loan Providers . Apply online now and get instant Approval.

If you want take Loans

ReplyDeleteReach with Us

Mortgage brokers Melbourne

Best Personal Loan Melbourne

Home Loan Brokers Melbourne

Commercial Property Loan

Home Loans Melbourne

Home Loan Interest Rates

Car Loans Melbourne

Home Loan Rates

If you want take Loans

ReplyDeleteReach with Us

Mortgage brokers Melbourne

Best Personal Loan Melbourne

Home Loan Brokers Melbourne

Commercial Property Loan

Home Loans Melbourne

Home Loan Interest Rates

Car Loans Melbourne

Home Loan Rates

I think most people would agree with your awesome article which is specially related of Property Manager. I am going to bookmark this web site so I can come back and read more articles. Keep up the good work!

ReplyDeleteProperty Manager

Most valuable and fantastic blog I really appreciate your work which you have done about the real estate broker,many thanks and keep it up.

ReplyDeletereal estate broker

Such an amazing blog about the real estate broker and I really appreciate you work which you have done well.

ReplyDeletereal estate broker

Well done and nice job ex client work and useful information about the garage plans. nice job.

ReplyDeletegarage plans

Very informative article which is about the Realtor Oakland County and i must bookmark it, keep posting interesting articles.

ReplyDeleteRealtor Oakland County

Such an amazing blog about the Real Estate Agent Oakland and I really appreciate you work which you have done well.

ReplyDeleteReal Estate Agent Oakland

Hi, Thanks for your great post, there are much nice information that I am sure a huge number of guys and gals don’t know.

ReplyDeleteReal Estate Investment

Hello Everybody,

DeleteMy name is Ahmad Asnul Brunei, I contacted Mr Osman Loan Firm for a business loan amount of $250,000, Then i was told about the step of approving my requested loan amount, after taking the risk again because i was so much desperate of setting up a business to my greatest surprise, the loan amount was credited to my bank account within 24 banking hours without any stress of getting my loan. I was surprise because i was first fall a victim of scam! If you are interested of securing any loan amount & you are located in any country, I'll advise you can contact Mr Osman Loan Firm via email osmanloanserves@gmail.com

LOAN APPLICATION INFORMATION FORM

First name......

Middle name.....

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8) Email address..........

9) Monthly Income:.....................

10) Occupation:...........................

11)Which site did you here about us.....................

Thanks and Best Regards.

Derek Email osmanloanserves@gmail.com

Ex client work and absolutely very nice information about the real estate agents it's good work.

ReplyDeletereal estate agents

Where can I get cheap teen decor online?

ReplyDeleteatlanta floor and decor

This comment has been removed by the author.

ReplyDeleteIf you want take Loans

ReplyDeleteReach with Us

Mortgage brokers Melbourne

Best Personal Loan Melbourne

Home Loan Brokers Melbourne

Commercial Property Loan

Home Loans Melbourne

Home Loan Interest Rates

Car Loans Melbourne

Home Loan Rates

Super blog and very interesting information which I always wanted to search many article but you article is really fantastic.

ReplyDeleteeugene real estate photography

nice work with a valuable information about the real estate good work.

ReplyDeletereal estate agents

Majoring in Business Law?

ReplyDeleteSarasota construction attorney

Very interesting and informative blog and about the Commercial Real Estate and I must appreciate your work well done keep it up.

ReplyDeleteCommercial Real Estate

This is a really good read for me, Must admit that you are one of the best bloggers I ever saw.Thanks for posting this informative article. I really like the fresh perceptive you did on the issue. I will be back soon to check up on new posts! Thank you!

ReplyDeleteResidential Real Estate Appraiser

We give you loan with a low interest rate of 2% and loan duration of 1 to

ReplyDelete30 years to pay back the loan (secure and unsecured). Do not keep your

financial problems to yourself in order for you not to be debt master or

financial stress up, which is why you must contact us quickly for a

solution to your financial problems. It will be a great joy to us when you

are financially stable. Email (Adamfredloanfirm@yahoo.com) or Text or call

us on +15017229938 OR +18144768385

Reply

nice work keep it up good blog i appreciate you just find here n=more details about home buying tips in Florida you also enjoyed it thank you all and also blogger ....

ReplyDeleteHello Everybody, My name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of S$250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of S$250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com)

ReplyDeleteMRS. IRENE QUERY FINANCE IS THE BEST PLACE TO GET A LOAN {mrsirenequery@gmail.com}

ReplyDeleteGod bless you Mum, I will not stop telling the world about your kindness in my life, I am a single mum with kids to look after. My name is Mrs.Rachel Alex, and I am from Singapore . A couple of weeks ago My friend visited me and along our discussion she told me about MRS.IRENE QUERY FINANCE, that they can help me out of my financial situation, I never believed cause I have spend so much money on different loan lenders who did nothing other than running away with my money. I have been in a financial mess for the pass 7 months now,She advised I give it a try so I mailed her and explain all about my financial situation to her, she therefore took me through the loan process and gave me a loan of $180,000.00 at a very low interest rate of 3% and today I am a proud business owner and can now take good care of my kids, If you must contact any firm to get any amount of loan you need with a low interest rate of 3% and better repayment schedule, please contact MRS.IRENE QUERY FINANCE via email{mrsirenequery@gmail.com}

Nice stuff as always!Thanks for taking time to create this informational resource..Its been very useful

ReplyDeleteVastgoed kopen in Spanje

huis kopen in spanje

Protect your credit from disaster of a foreclosure. Sell your house fast for cash and protect the equity of your home. Yes, it is possible! Get in touch with sellyourhousefastforcashdallas.com to know more on how you can sell your home for fast cash and prevent foreclosure.

ReplyDeletehttp://sellyourhousefastforcashdallas.com/

I really found very interesting about these topic because you have good content and unique thoughts on writing. So this might be useful to everyone. I really look forward some more updates. Thanks for sharing.

ReplyDeleteReal Estate Investors

We offer personal loans up to $100,000, Are you looking for a business loan and have been denied by a bank, we can help with loans from $5,000 to the maximum amount $100,000* that can help you rebuild your business and get you back ^, We can put you on a path towards a better financial future.

ReplyDeleteJust in time, you can apply in minutes and get your cash the same day.

Don't delay! email via mail.us { samsulalamcashfirm@gmail.com } or visit us at one of our 200+ locations across the would to see how we can help.

Thanks for contacting us,

Warm regards

Mr.Samsul Alam

samsulalamcashfirm

samsulalamcashfirm@gmail.com

Nice Information,Thanks for Sharing.

ReplyDeleteaccounting firms adelaide

Thanks for sharing this useful information.

ReplyDeleteCompany Tax Returns

Good Information.

ReplyDeleteFinancial Planning

Interesting blog all information are very important for me about the abbotsford townhomes and i really need it thank you.

ReplyDeleteabbotsford townhomes

ReplyDeleteHello!!! Do you want to be a member of the great illuminati and start receiving 50,000,000.00USD monthly and be popular among others and have riches and fame,,this is the only chance of being of the illuminati..I was sent by the freemason high chief to bring 52 members into the illuminati,I have gotten 32,so we looking for 20,,so try and be among the tweenty people to be rich and famous, WhatsApp us on +2348119239306 OR Email us on: illuminatiword0666@gmail.com, so we can begin the joining process!!!

Plant Risk Assessment : We provide services for Plant Risk Assessment, Plant Safety Assessment, Plant Auditing, Plant Regulation

ReplyDeleteAre you in need of a loan? Do you want to pay off your bills? Do you want to be financially stable? All you have to do is to contact us for more information on how to get started and get the loan you desire. This offer is open to all that will be able to repay back in due time. Note-that repayment time frame is negotiable and at interest rate of 3% just email us creditloan11@gmail.com

ReplyDeleteDo you need a Loan? if yes please email us now at charles_din@hotmail.com with the below information filled

ReplyDeleteName:...

Country:..

Amount Needed:..

Duration:..

Phone:...

Please reply to: charles_din@hotmail.com

Nice information

ReplyDeleteAdelaide Accountant

LOAN OFFER!!!

ReplyDeleteWe are Berkshire Loan Service we Provides both long and short term loan financing. We offer secure and confidential loans at a very low interest rate of 2% per year, Personal loans, Debt Consolidation Loan, Venture Capital, Business Loan, Corporate Loans, Educational Loan, Home Loan and Loans for any reason!

We are the trusted alternative to bank financing, and our application process is simple and straight forward. Our loan ranges from $5,000.00 to $25, 000,000.00. (Twenty Five Million Dollars). Additional Info: We're fast becoming the private, discreet, and service oriented lending choice for general loans. We're the company to turn to when traditional lending sources fail.

If you are interested do not hesitate to contact us with information’s below by Email, berkshire.hathaway@yahoo.com

Warm Regards,

Mr. Roy Smith,

Head, Loans Application Department,

Berkshire LOAN SERVICE,

Email: berkshire.hathaway@yahoo.com

Affordable Loan Offer ( PergoCF@qualityservice.com )

ReplyDeleteDo You Need A Business Loan? ( PergoCF@cheerful.com )

Interested applicants should Contact us via email: PergoCF@gmail.com

Interested applicants should Contact us via email: PergoCF@cheerful.com

A Personal Loan? At 1.00%

Name,Amount,Country,Loan Durations,Phone, Mobile:

Please, contact us for more information: PergoCF@qualityservice.com

Interested applicants should Contact us via email: PergoCF@qualityservice.com

Interested applicants should Contact us via email: PergoCF@cheerful.com

We work with individual investors and the company that provides merchant cash advance, asset based lending, commercial real estate refinancing, lines of credit, hard money loans, business acquisition financing, debt consolidation loans, and more. For more information, We encourage you to contact us and learn more about the financing services we offered. If you have any questions or want more information about our company, please feel free to email: Please, contact us for more information: PergoCF@qualityservice.com

Interested applicants should Contact us via email: PergoCF@qualityservice.com

Interested applicants should Contact us via email: PergoCF@cheerful.com

Personal loans may not be right for every borrower looking for a home improvement loan. For example, if you have significant equity in your home and are looking to borrow a large amount, you might be able to save money with lower interest rates on a home equity loan. Also, interest payments on home equity loans and lines of credit can be tax deductible under certain circumstances – that’s not the case with personal loans.

On the other hand, personal loans can make sense for:

*Recent homebuyers

*Smaller home improvement loans (e.g., bathroom or kitchen as opposed to full remodel)

*Borrowers in lower home value markets (if your home value has barely budged since you moved in, you may not have much equity to draw on for a home equity loan)

*Those who value ease and speed

*Borrowers with great credit and cash flow

While home equity loans and lines of credit are a good source of home improvement money if you’ve built up equity in your home, a personal loan may be a better alternative if you’re a new homeowner and need to take care of a few updates to make your new home just right. You can get an affordable loan for just one week. Please connect us at via E-mail Please, contact us for more information: PergoCF@qualityservice.com

Interested applicants should Contact us via email: PergoCF@qualityservice.com

Interested applicants should Contact us via email: PergoCF@cheerful.com

WELCOME TO THE GREAT BROTHERHOOD.

ReplyDeleteDo you want to be a member of Illuminati brotherhood that will make you rich and famous in the world and have power to control people in the high place worldwide?

Are you a business man or woman, artist, politician, musician, student, do you want to be rich, famous and powerful in life, join the Illuminati confraternity today and get instant rich sum of 2 million dollars in a week, and a free home any where you choose to live in this world and also get 10,000,000 U.S dollars monthly as a salary %u2026

BENEFITS GIVEN TO NEW MEMBERS WHO JOIN ILLUMINATI.

1. A Cash Reward of $500,000 USD

2. A New Sleek Dream CAR valued at $300,000 USD

3. A Dream House bought in the country of your own choice

4. One Month holiday (fully paid) to your dream tourist destination

5. One year Golf Membership package

6. A V.I.P treatment in all Airports in the World

7. A total lifestyle change

8. Access to Bohemian Grove

9. Monthly payment we be given to the new member

10. One Month booked Appointment with Top 5 world leaders and Top 5 Celebrities in the World.

If you are interested of joining us in the great brotherhood of ILLUMINATI

email us,worldilluminati468@gmail.com OR call +2349036317149

Please contact us for your secure and unsecured loan at on interest rate of 3%............................... ......... Hello, is the difficulty of the economy Affecting you this year, is your bank refuses to give you a loan? If your answer is yes, then you need a loan. I'm Mr Lee Chang,the owner of a lending company We offer safe and secure loans at on interest rate of 3%. * Are you financially squeezed? * Do you seek funds to pay off credits and debts? * Do you seek finance to set up your own business? * Are you in need of private or business loans for various purposes? * Do you seek loans to carry out large projects? If you have any of the above problems, we can be of assistance to you but I want you to understand did we give out loans at the interest rate of3%. * Borrow anything up to $ 90,000,000 USD. * Choose between 1 to 30years to repay. * Choose between Monthly and Annual Repayments plan. *Flexible Loan Terms. Please if you are interested check back with us through this email address: leechangloancompany.ch@gmail.com We promise a 100%guarantee did you want to receive your loan at the end of this loan transaction.There is no security check, no credit check Regards LEE CHANG LOAN COMPANY

ReplyDeleteDo You Need A Business Loan,Or A Personal Loan,At 1.0% If Yes? Name,Amount,Country,Loan Durations,Phone Mobile:Please, Interested applicants should Contact us via email: PergoCF@gmail.com , ( PergoCF@qualityservice.com ) , PergoCF@cheerful.com

ReplyDeleteDo You Need A Personal Loan Or Business Loans? If Yes Email: Your Name:Amount needed:Duration:Country:Mobile:Contact Us Via Email: PergoCF@cheerful.com

DO YOU NEED FINANCIAL ASSISTANCE? PergoCF@cheerful.com

Affordable Loan Offer ............. PergoCF@gmail.com

Do you need a business loan? PergoCF@qualityservice.com

Do you need a business loan? PergoCF@cheerful.com

Interested applicants would contact us via email: PergoCF@gmail.com

Interested applicants would contact us via email: PergoCF@cheerful.com

Interested applicants would contact us via email: PergoCF@qualityservice.com

Thanks for sharing your info. I really appreciate your efforts and I will be waiting for your further write ups thanks once again.

ReplyDeletecommercial house for sale

Hello Everybody,

ReplyDeleteMy name is Ahmad Asnul Brunei, I contacted Mr Osman Loan Firm for a business loan amount of $250,000, Then i was told about the step of approving my requested loan amount, after taking the risk again because i was so much desperate of setting up a business to my greatest surprise, the loan amount was credited to my bank account within 24 banking hours without any stress of getting my loan. I was surprise because i was first fall a victim of scam! If you are interested of securing any loan amount & you are located in any country, I'll advise you can contact Mr Osman Loan Firm via email osmanloanserves@gmail.com

LOAN APPLICATION INFORMATION FORM

First name......

Middle name.....

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8) Email address..........

9) Monthly Income:.....................

10) Occupation:...........................

11)Which site did you here about us.....................

Thanks and Best Regards.

Derek Email osmanloanserves@gmail.com

Wow!nice article and containing allot of information about the property well done.

ReplyDeleteDynasty Real Estate

This blog is having the very nice information about real estate. Here we can have all the information about it.

ReplyDeleteearning 100% commission

HOW I GET A LOAN HELP @ 2% INTEREST RATE With victoriafinancier@outlook.com

ReplyDeleteI was not sure of getting a legit loan lender online But when i could not face my Debt any more, my son was on hospital bed for surgery that involve huge money and i also needed some money to refinance and get a good home then i have to seeks for Assistance from friends and when there was no hope any more i decide to go online to seek a loan and i find VICTORIA LAWSON Trust Loan Firm (victoriafinancier@outlook.com) with 2% interest Rate and applied immediately with my details as directed. Within seven Days of my application She wired my loan amount with No hidden charges and i could take care of my son medical bills, Renew my rent bill and pay off my debt. I will advice every loan seeker to contact VICTORIA LAWSON LOAN Company with victoriafinancier@outlook.com For easy and safe transaction.

*Full Name:_________

*Address:_________

*Tell:_________

*loan amount:_________

*Loan duration:_________